ATLANTA, Feb. 8, 2021 – JLL announced today that it has closed the $166.7 million sale of a core industrial portfolio comprising three net-leased, Class A, newly constructed bulk distribution assets totaling nearly 2.2 million square feet in two top logistics markets, Atlanta, Georgia, and Memphis, Tennessee.

JLL Capital Markets worked on behalf of the

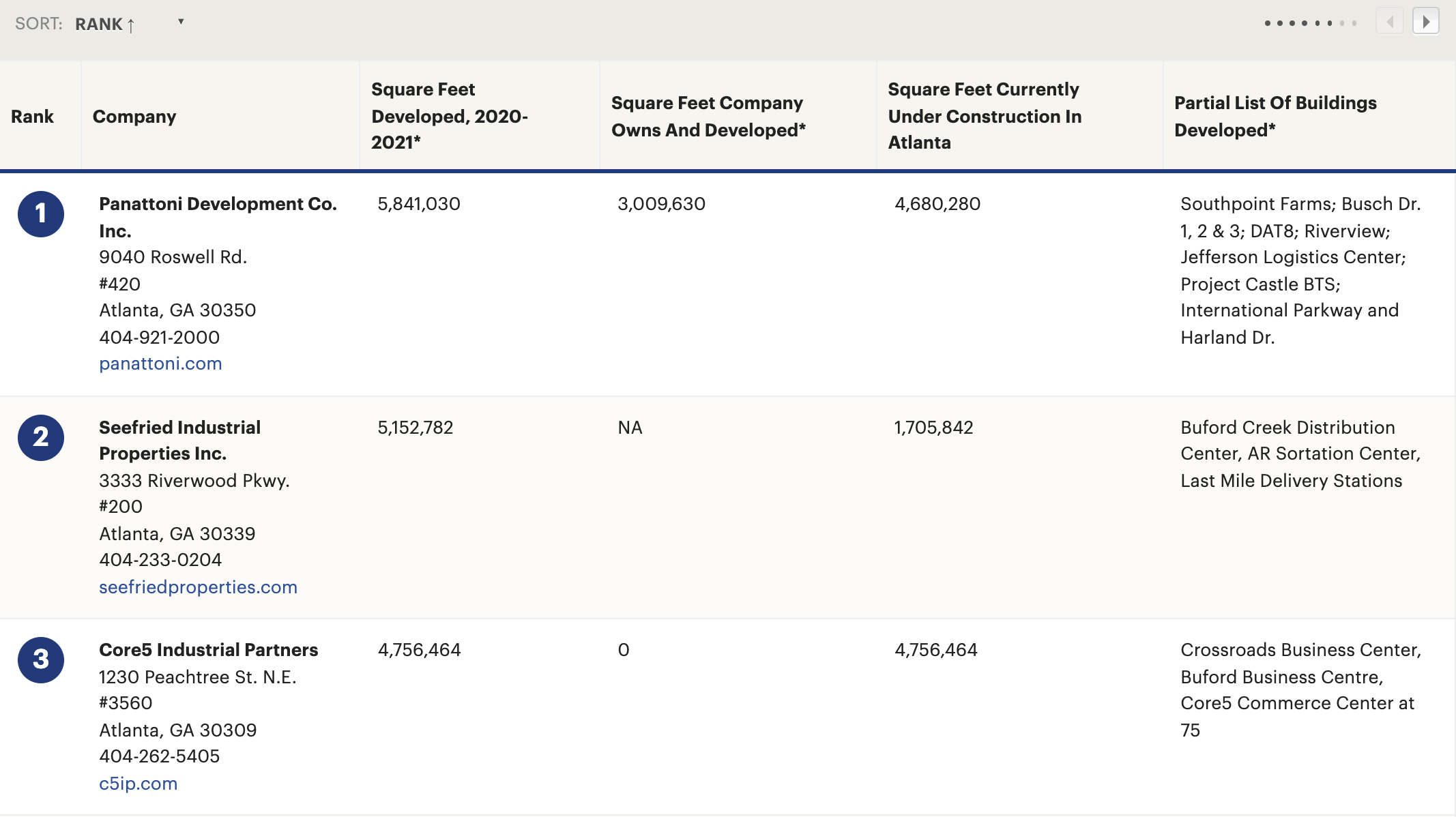

seller, Core5 Industrial Partners. Preylock Holdings purchased the assets. Additionally, JLL Agency Leasing assisted Core5 Industrial Partners lease the Atlanta component of the portfolio to a credit-worthy e-commerce retailer.

The portfolio consists of the 1-million-square foot Crossroads Business Center at 5705 Campbellton Fairburn Rd. in Union City, Georgia, and two buildings that are part of the DeSoto 55 Logistics Center, the 328,355-square-foot DeSoto A2 and the 860,915-square-foot Desoto D at 1453 and 1615 Commerce Pkwy. in Horn Lake, Mississippi. These infill locations are near highly trafficked trucking and logistics routes near Hartsfield-Jackson Atlanta International Airport, the busiest airport in the world, and Memphis International Airport, which houses the FedEx Express World Hub. Additionally, both properties are proximate to unparalleled regional access and intermodal facilities.

Completed in 2020 to core, Class A state-of-the-art construction specifications, the buildings have ESFR sprinklers, ample auto parking and trailer storage, clear heights ranging from 36 to 40 feet and abundance of dock-high doors with view windows.

JLL Research found that net lease assets captured nearly a fifth of all commercial real estate investment activity during the second and third quarters of 2020, doubling the average over the last cycle. Throughout the pandemic, some investors turned to the relative certainty of long-term, net-lease properties with a strong credit tenant, like this portfolio. Additionally, persistent demand for e-commerce and logistics assets in the wake of COVID-19 drove the strong performance of the net-lease industrial sector last year.

The JLL Capital Markets team representing the seller was led by Dennis Mitchell, Matt Wirth

, Britton Burdette

, Jim Freeman and Mitchell Townsend.

“The transaction was creative and designed to accomplish several goals for Core5, including strong pricing at time of the initial pre-election funding and a 2021 final funding and tax event,” Mitchell says. “Buyers' willingness to be aggressive in both price and transaction structure demonstrates the continued demand for core industrial product. This complicated transaction progressed from term sheet to closed in under 45 days, which is a credit to the quality of Core5 Industrial Partners, Preylock and all involved.”

The JLL Atlanta Agency Leasing team of Reed Davis and Bob Currie represented Crossroads Business Center, and Jack Wohrman with JLL’s Memphis office was the lead market expert for the DeSoto assets.

“Memphis Industrial market fundamentals continue to get better and better,” Wohrman added. “Vacancy rates are at historic lows, absorption continues to outpace deliveries, rents are increasing and cap rates continue to compress. We achieved strong pricing for the Memphis market and entire Mid-South on behalf of Core5 with this transaction. The collective efforts between our Capital Markets and Industrial Brokerage teams worked incredibly well on this complicated project.”

JLL Capital Markets is a full-service global provider of capital solutions for real estate investors and occupiers. The firm's in-depth local market and global investor knowledge delivers the best-in-class solutions for clients — whether investment sales advisory, debt placement, equity placement or a recapitalization. The firm has more than 3,700 Capital Markets specialists worldwide with offices in nearly 50 countries.

For more news, videos and research resources on JLL, please visit our

newsroom.